The Money Mastery Bundle | Pack of 3

Take control of your financial life with The Money Mastery Bundle – a powerful 3-in-1 notebook set designed to help you budget better, grow your savings, and eliminate debt with ease. Whether you’re starting your money management journey or levelling up your financial habits, this trio of thoughtfully designed planners makes tracking your finances feel simple, motivating, and achievable.

Description

Three Notebooks to Organise Your Budget, Savings, and Debt

Take control of your financial life with The Money Mastery Bundle – a powerful 3-in-1 notebook set designed to help you budget better, grow your savings, and eliminate debt with ease. Whether you’re starting your money management journey or levelling up your financial habits, this trio of thoughtfully designed planners makes tracking your finances feel simple, motivating, and achievable.

Each bundle includes:

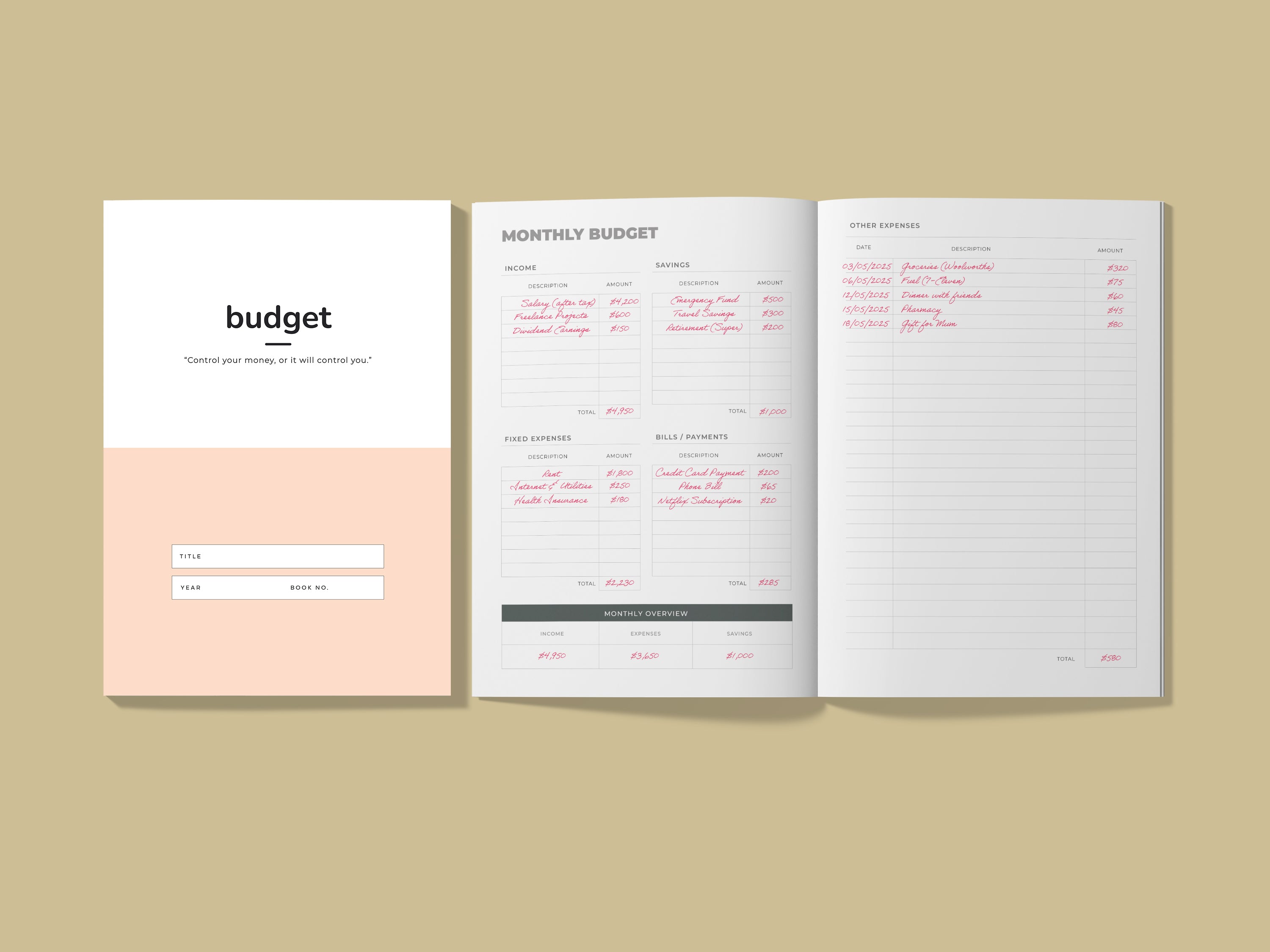

✔ Budget Planner Notebook – Plan your monthly income, expenses, and savings.

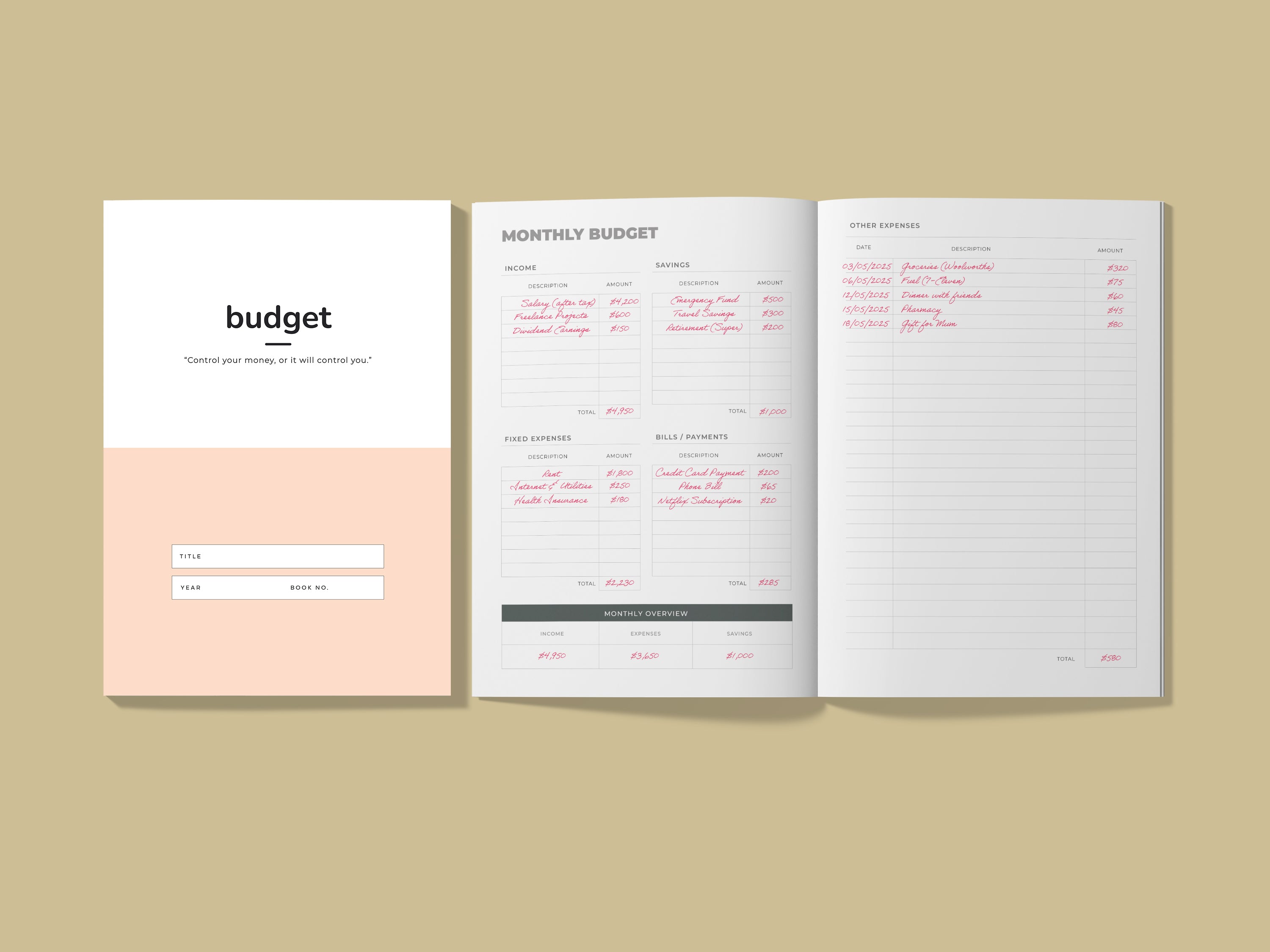

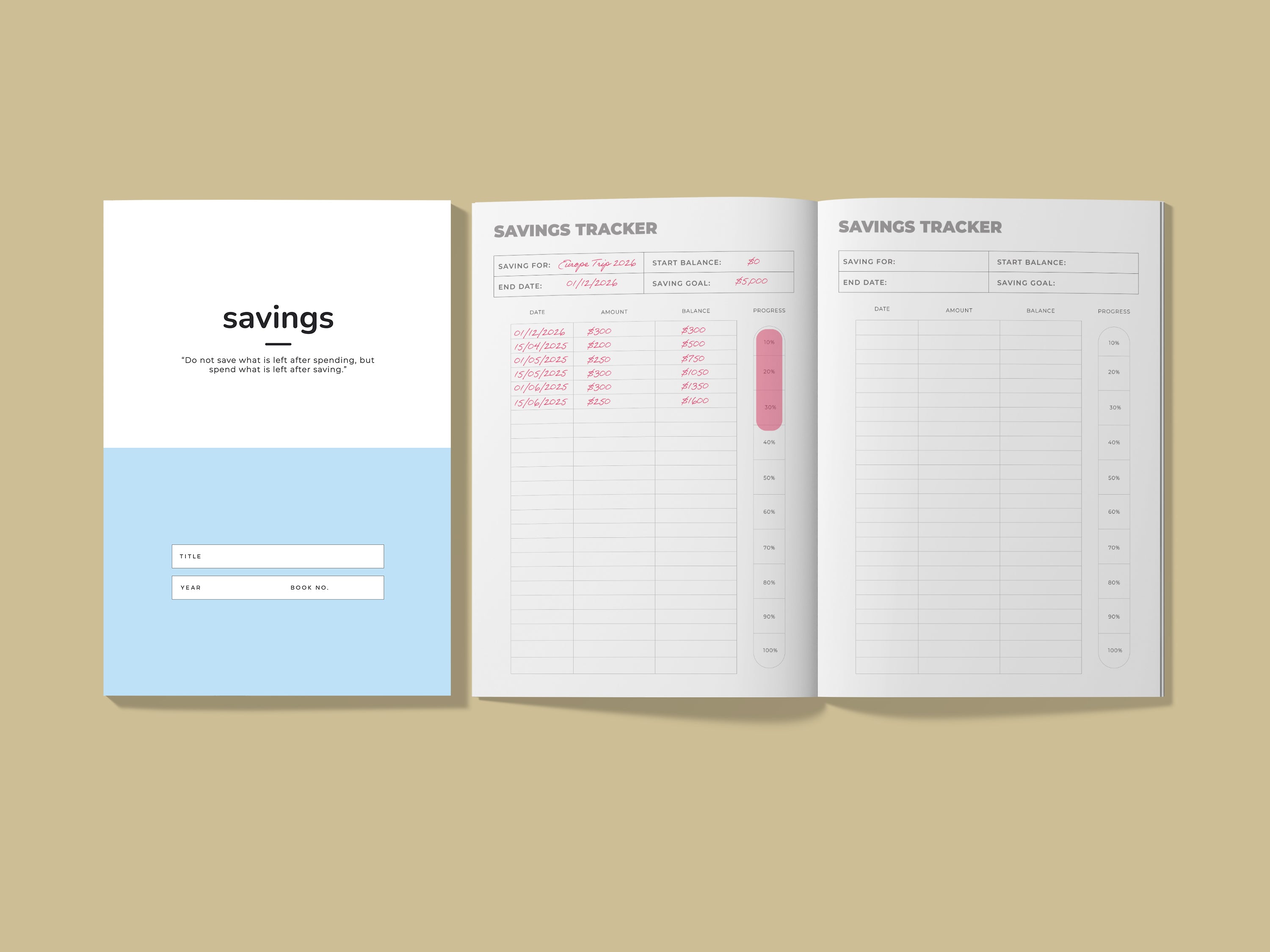

✔ Savings Tracker Notebook – Set a goal and visually track your progress.

✔ Debt Tracker Notebook – Stay on top of repayments and reduce debt with clarity.

Ideal for personal use, couples, or young professionals looking to get organised and build healthy money habits—without digital overwhelm.

Why You'll Love It:

✅ Easy-to-use, clutter-free layouts

✅ Visual progress bars to stay motivated

✅ Made in Australia with high-quality paper stock

✅ Great gift idea for graduates, partners, or yourself

Perfect for:

- Monthly budgeting

- Travel and emergency fund saving

- Credit card and loan repayment

- New year money goals

- Conscious spending and financial clarity

Features

Size: 140 x 210mm (~A5)

Cover Page : 310 gsm

Inside Page: 120 gsm

No. of pages : 48 / book

ISO14001 certified, 100% FSC certified

Consideration: This is a pictorial representation of the product, the actual texture, colour, and design might differ slightly.

What's Included?

Three Notebooks to Organise Your Budget, Savings, and Debt

✔ Budget Planner Notebook – Plan your monthly income, expenses, and savings.

✔ Savings Tracker Notebook – Set a goal and visually track your progress.

✔ Debt Tracker Notebook – Stay on top of repayments and reduce debt with clarity.

Shipping & Returns

We use Australia Post for most of our deliveries. You can expect your parcel within 2-8 business days from when it leaves our studio.

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

- for more info please refer to our refund policy

Pairs well with

Locally Designed & Printed

Proudly crafted in Melbourne, supporting local production.

Free Shipping

Get free shipping on orders of $100 or more

Unmatched Turnaround Times

Dispatched in 2-4 Business Day. Among the fastest in the industry.

Monthly Budget Planner

Take charge of your money with our Monthly Budget Planner Notebook, designed to help you track income, fixed expenses, bills, savings, and other costs all in one place. Whether you're budgeting weekly or monthly, this practical finance notebook makes it easy to plan ahead and spend intentionally.

Each page includes a dedicated section for income, savings goals, recurring payments, and a monthly overview so you can review your financial habits at a glance.

✔ Ideal for personal, household, or small business budgeting

✔ Minimalist layout for easy use

✔ Perfect companion for financial planning and money management

Savings Tracker Notebook

Whether you're saving for a holiday, emergency fund, home deposit, or a big purchase, our Savings Tracker Notebook helps you stay focused and motivated.

Record your savings goals, track deposits over time, and see your progress grow with a visual tracker on every page. With a clean and simple layout, this notebook makes saving money a joyful, achievable habit.

✔ Helps you stay consistent with your savings

✔ Includes goal setting, balance tracking & progress bar

✔ Great for short- or long-term goals

Debt Tracker Notebook

Ready to pay off your debt and take control of your financial future? The Debt Tracker Notebook helps you reduce credit card debt, personal loans, or student loans one payment at a time.

Track payment history, monitor your balance, and celebrate each step with a visual progress bar built into the layout. It's the perfect tool to stay committed to your debt-free journey.

✔ Track credit card, personal, or student loan debt

✔ Encourages mindful money habits

✔ Visual progress tracking to keep you motivated

FAQs

Please read our FAQs page to find out more.

What comes in the Money Mastery Bundle?

The bundle includes three beautifully crafted A5-sized journals:

Budget Planner for tracking income, expenses, and savings

Savings Tracker to set and monitor financial goals

Debt Tracker to help manage and reduce debt strategically

Each journal includes 46 guided pages, printed on premium 120 GSM FSC-certified paper.

What are the dimensions and materials used?

Each notebook measures 14.4cm x 21cm (A5) – compact yet spacious.

: Thick 310 GSM soft-touch paperboard for durability

: 120 GSM smooth writing paper for minimal bleed-through

: Made with FSC-certified paper, proudly crafted in Australia

They’re eco-conscious, luxe in feel, and made to last.

Can these journals be used as refills for your leather covers?

Yes! These are designed to perfectly fit inside our vegan leather journal covers, making it easy to refill and customise your journaling setup as your needs evolve.

How long will each notebook last?

Each notebook includes 46 printed layout pages, allowing for several weeks or months of tracking depending on how often you log entries. They're perfect for regular monthly use or focused short-term goals.

Can I start using these journals at any time of year?

Yes – the layouts are undated, so you can begin tracking your finances anytime, without waiting for a new year or month to start.

Are these suitable for beginners?

Absolutely. Whether you're just beginning your money journey or already managing your finances, these journals offer a simple, guided format that’s easy to follow and helps build long-lasting financial habits.

Is this bundle good for gifting?

Yes – it’s a thoughtful, premium-quality gift for graduates, newlyweds, new homeowners, or anyone starting a financial reset. You can also pair it with a vegan leather folio for an elevated touch.

What’s the difference between this and budgeting apps?

Unlike digital apps, these journals offer a tactile, focused experience. Writing things down on high-quality paper encourages reflection, reduces screen time, and helps make your financial goals more intentional and memorable.